After all my learning through both painful experience and miles of research into personal finance over these past 12 years, I have come to this conclusion:

If you don’t look after your money, no-one else will.

If you think that your Super is someone else’s problem, don’t believe it. It’s yours to manage, with annual reviews to make sure you are on track to live comfortably, when the time comes.

Keep the management costs low by selecting your Super Fund manager wisely, make sure you put in more than any life insurance and fees coming out, and if over 50, increase your sacrifice to super to make contributions up to 17% a year, if at all possible. (My own super fund has benefited from my active management, even if I cannot put in as much as 17%).

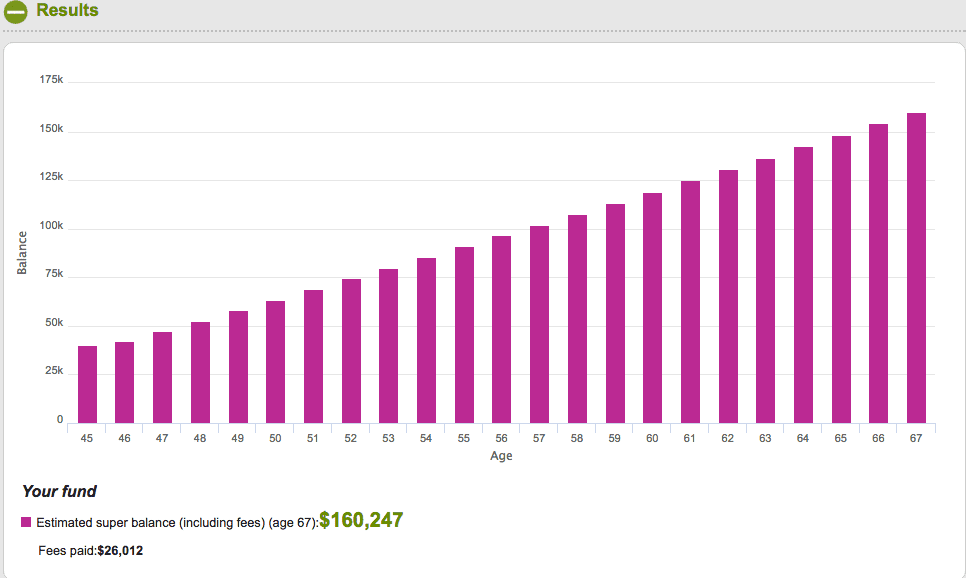

Sometimes in hardship, some people consider drawing on their Super fund. And if it means a lot to you not to be declared in bankruptcy, then OK, but people also consider accessing it for things like renovations. Generally middle-class Australians are being squeezed out of receiving age pensions (with asset tests) because of the new demands via our ageing population. So, if you dip into your Superannuation now, you will be sacrificing your own lifestyle down the track. There are online calculators which allow you to see different scenarios of how your Superannuation alters with more contributions (after 15% tax).

Wealth Building Through Super

Wealth building via your Superannuation has both advantages and disadvantages. You can now lend more against the super fund’s assets, but it must be with the intention of keeping the investment long term. You can do this through a SMSF tied to a unit trust (via a qualified SMSF specialist). General superannuation accounts through a retail manager or industry fund do not qualify for lending.

You can see from this Startsat60 low rates article that a conservative retired investor is now struggling if relying on investments that are solely fixed interest, cash or bonds. So allocation of your funds into several different asset areas — some of which will have higher risks and returns — may be needed.

A disadvantage of a smaller SMSF (or regular fund) might be that your Superannuation monies are not diversified. Some people intent on wealth building might put all their pennies into one asset type and very little else, and that is not a sound strategy. And don’t take this as gospel, but over $200,000 usually makes a SMSF, with its higher costs, work out better.

Coming soon, a new book by Jennifer Lancaster.

Jump on our list for notices about Creative Ways with Money if you’re…. tired of cons and red herrings, and want to learn some cool and creative ways to:

- save on your everyday bills

- invest in shares in small ways

- start a side business or

- find other investing solutions

Super and Working for Yourself

It doesn’t matter if you’re starting small either. Adding more to your Super through salary sacrifice or voluntarily (if you work for yourself) every month automatically is a great idea. As you can see from the chart, it helps your fund along toward $150,000+ — despite being low paid. This chart is from the perspective of a SELF-EMPLOYED worker, so rather than a paltry $43,000, this lady would have $160,000 after putting in 11% from after-tax income (which equals $4,950 p.a. or $412 per month).

Anything you can put aside today to improve your future self’s situation, is a good thing… so don’t put it off!

In Conclusion

Looking after your Super is about making the most of what you’ve got, i.e. getting good value through solid asset allocation for the long term (for example, 30% defensive/70% growth — this would depend on your life stage), with lesser fees and minimum tax.

The next step is to add to what you’ve got, and at the same time keep aside an emergency fund – so you don’t have to break into your Super during an unforeseen event.

If you’d like to know more about managing money and investing for the novice, please see my book How to Control Your Financial Destiny. (You really don’t need to know anything about finance to understand it).

This post has been written as an educational tool, so it may not be appropriate for your individual circumstances. Consult a qualified financial adviser before making a financial decision.