If you take the step of setting a big goal that excites you, you’ll at least be putting it into your vision. But some stab at a goal without really considering all the factors. Are they aiming correctly?

In 2003, I had two goals: meet a man and write a book. I had a list of desired attributes and my write a book goal was written on a piece of paper, taped to the wall. Since dating and this blog have little in common, let’s quickly move to the book goal. What happened?

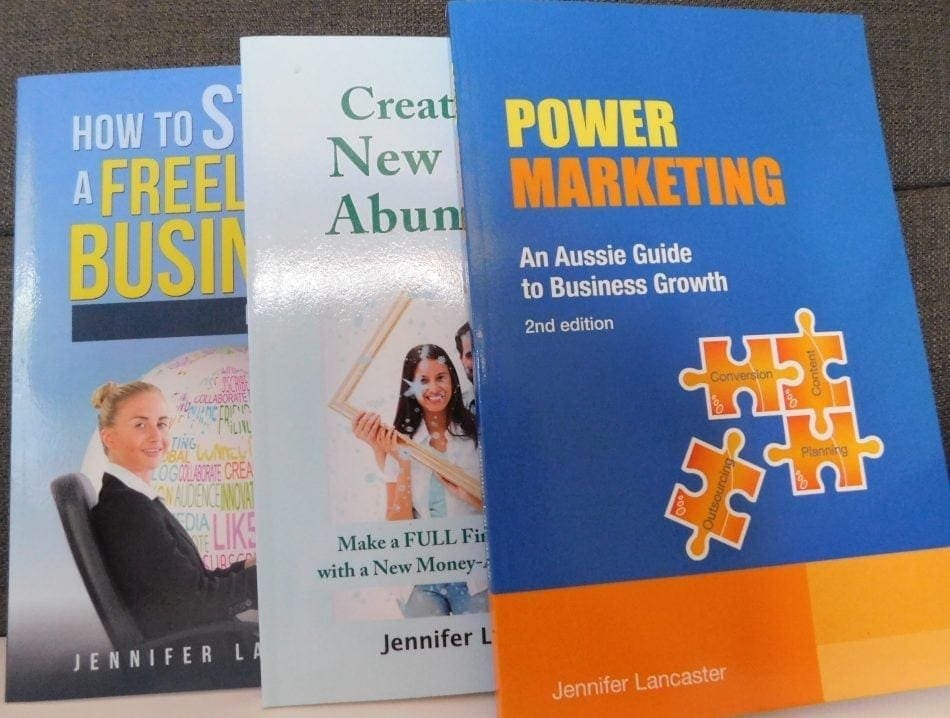

By 2005 I was madly writing it. The resulting book was tiny; just 46 pages, but the underlying goal motivated me to bumble along the path. I wanted to finish and quickly; I had our baby crawling around, getting into things! With a cover by a local designer, in 2005/6, I loaded ‘How to Kick Bad Spending Habits… and save for what you really want’ onto Lulu and went back to living. Lulu.com transferred it to eBook for me, for free, and the eBook started selling all by itself. It had cost me nothing and it was earning!

THIS JUST DOESN’T HAPPEN these days. Sorry for shouting, but I just wanted to point out you can’t expect books to start selling well from a great title, cover and blurb alone.

I had taken a step into the unknown, and I liked it. But had I formed the right goal? After all, I had not considered the big picture.

Three Types of Goals

While many of us dream of ‘having’ assets and shiny stuff, Goals can have three types*:

- Being

- Doing

- Having

*Borrowed from Tim Ferris, Four-Hour Week.

Retirement Funds is a HAVE Goal, Self-Funding is a BE Goal

If a 50-something worker wants to retire with $500,000 / $60,000 per year… (having goal) is that the right type of goal? It might not be, because of unique factors. Perhaps step back and think about what you want to BE. In the 50-yo’s case it could be: BE a self-funded retiree.

From this perspective, it means that the figure needed might not be as high, if he or she plans continuing a business income stream… or it might need to be higher, if they plan to fully retire at 67 with a spouse and be healthy for 30 years.

Check your retirement goals here: https://moneysmart.gov.au/how-super-works/superannuation-calculator

Back to goal setting, what kind of life do you want to live? Not just in retirement, but in one year’s time? What will your life look like in five years’ time? Is sacrificing $300 a month towards a deposit or ETF investment going to be worthwhile because it is building your future wealth?

What will you do to get yourself on the path toward major goals? What hurdles will you need to overcome? Are you prepared to solve little problems (like techy stuff) and still remember your long-term vision?

Make Three Milestones

Reaching short term milestones can get us juiced for more action.

As one of my Goals is to create an online asset, one milestone is to go to HerBusiness Live in Sydney and learn more about growing a business. (HerBusiness membership has changed the way I think about creating a lasting business). Last year I would have dismissed a seminar in another state as a flight of fancy. Another milestone is to grow my email list to 1,000 people, because it’s then much easier to get in touch with people who want education.

This is a doable step towards my bigger goal of an online asset. The way I look at growing a publishing library and courses at business author academy is not short-term, but I can get excited by things taking place in the short term.

What are the next three milestones for your major sales or revenue goal?

Recurring Memberships as a Goal

If you’ve determined a goal of earning a recurring revenue while building an educational portal, then I suggest viewing Stu McLaren’s Tribe Workshop series. These videos are a pleasure to watch and it will give a ‘big picture’ view on the idea of a recurring membership portal. Download his resource: the Market Assessment Workbook, as well.

Share your goal with me if you like, in the comments, and what steps you are currently taking to get there.