Last year in Australia, people could access their Superannuation of up to $10,000, if suffering because of COVID19 layoffs. However, it seems that four in 10 Australians who withdrew from their super under the Federal Government’s Early Super Access Scheme actually saw no drop in their income. In fact, as some were collecting stable Jobkeeper payments rather than being a part-time casual worker, 21% of these recipients had their overall earnings rise by more than 10%. (Collated data – source Savings.com.au)

Recipients of the second round of Super withdrawals spent $3,618 more in the fortnight after receiving their funds, compared with the bank’s customers normal earnings. The second round of super access also showed that most used nest egg money to increase spending in a burst. And 64% of the spending was on discretionary items (non-essentials). (Source: de-identified AlphaBeta analytics)

These figures tell a story of people who were tired of being at break-even and just took an opportunity to get access to their funds and spend it. It also says, damn, those analytics firms really analyse every little detail of our bank accounts!

The Future of the Super Guarantee Scheme

Australia’s government is looking to put up the employee super from 9.25% to 12% in 2021, which seems good news for employees who took long breaks from work. However, there are a few arguments against this.

One, there has been stagnant wage growth for five years, and because employers only give modest pay rises at best in modest growth times, this increase will mean a rise in a company’s wages bill without that naturally flowing to the employee’s hands.

Another sad reality is that the taxation benefits of the whole Super scheme flows more to higher-income earners. This is because high earners can add extra funds at only 15% tax in most cases, and earn lower-taxed yields. Because the Federal Government is propping up these Superannuation tax concessions, the cost of this initiative is growing so much that it’s “expected to eventually exceed that of the entire age pension expenditure by about 2050”, according to the Retirement Income Review, a hefty tome compiled by Mike Callaghan. (ABCnews.com.au)

What about Accessing Your Super when Young?

As owning a house in old age is a more independent and cheaper way to live, there are calls for making it easy to access superannuation for working young people today.

Does superannuation really matter to a young person? Or should they be able to apply for that savings for a house deposit?

“Yes, someone should be able to access their super for a house deposit when 20-29, but if they’re 30, they should start saving towards retirement by about then”.

– Student

It makes sense for those of us who are self-employed and had time out from the workforce to raise a child/children (and to go to University) to try to play catch-up. I feel this is a better option than putting our heads in the sand and then panicking at age 60 that there will not be enough to live on. Especially with an ever-wavering age pension.

A Personal View on Saving with a Super Fund

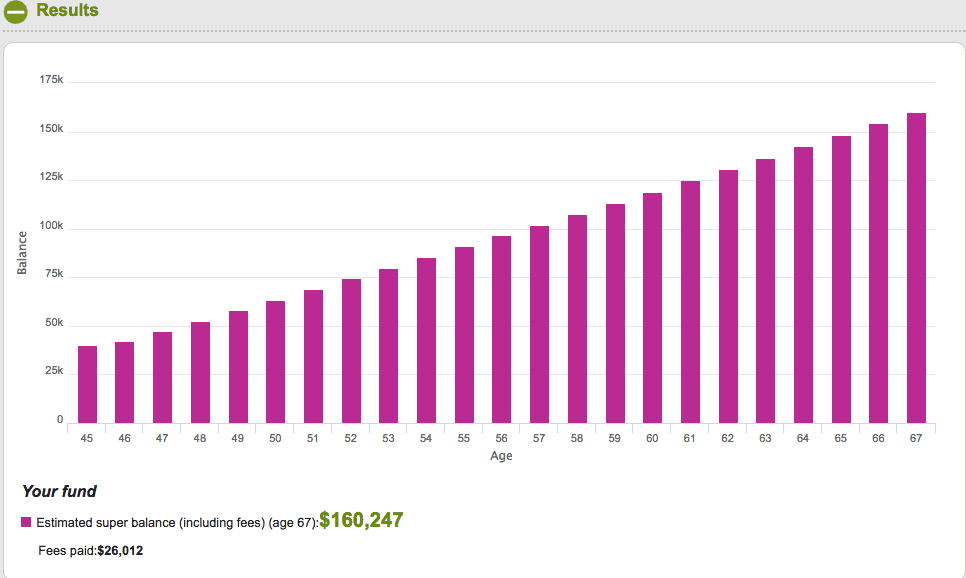

Yes, I have had some luck with gaining ground with voluntary Superannuation from a low base. As a self-employed person (sole trader), it is up to me what amount I put in, so naturally I squirm and put minimal amounts. HOWEVER, assessing whether my money is in the correct asset class every year has meant solid gains over the past ten years. The chart below done in 2018 shows a projection up to age 67, pension-based retirement age. I also recently changed funds after an assessment of superannuation fund performance.

However, I am now 50 and my Super has exceeded this projection — it is at about $80,000. Still with the paltry amounts put in (nowhere near 9.5%).

If you’d like to learn more about the financial independence mindset, then my ebook How to Control Your Financial Destiny ($3.99) covers this. There’s more about overcoming financial trials to get ahead, in the second book in the Know Your Finances series: Create Your New Life of Abundance.

The third book, Creative Ways with Money (2020) helps you ward off scams as you understand better how to earn more from side hustle income, save money in easy ways, and find lost bank accounts.